What is Customer Lifetime Value (CLV)? A Complete Guide

Learn what Customer Lifetime Value (CLV) is, why it's crucial for business growth, and how to calculate and improve this key metric.

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is a foundational metric that predicts the total net profit a business can expect to earn from a single customer over the entire duration of their relationship. It's more than a simple revenue figure; it's a strategic lens that helps companies identify high-value customers, allocate resources efficiently, and drive sustainable, profitable growth. By shifting focus from one-time transactions to the long-term value of a customer relationship, CLV empowers teams across sales, marketing, and product to make smarter decisions.

Why CLV is a Critical Business Metric

Understanding CLV transforms how you view your customer base. It moves the goalpost from acquisition at any cost to cultivating profitable, long-term relationships. A core principle is that your Customer Lifetime Value should be at least 3 times greater than your Customer Acquisition Cost (CAC). This LTV:CAC ratio is a vital health check for any business model.

Focusing on CLV helps you:

- Reduce churn by identifying and retaining your most valuable customers.

- Increase profitability by guiding marketing spend toward audiences with higher long-term potential.

- Drive sustainable revenue growth, as upsells and cross-sells can account for 31% of revenue.

How to Calculate Customer Lifetime Value

While the core concept is straightforward—total customer value minus costs—the calculation can vary. The most common approach is a mathematical formula that projects the present value of a customer. A standard formula is:

CLV = (Average Purchase Value × Purchase Frequency × Customer Lifespan)

For a more nuanced, profit-focused view common in SaaS, the calculation becomes an estimate of the projected total net value, considering both revenue and the costs to serve the customer over their lifetime.

It's important to distinguish between a literal accounting of past revenue and the forward-looking, predictive nature of CLV. As noted in industry definitions, CLV is typically an estimate of the projected total value of a customer over its lifetime, not just a historical tally.

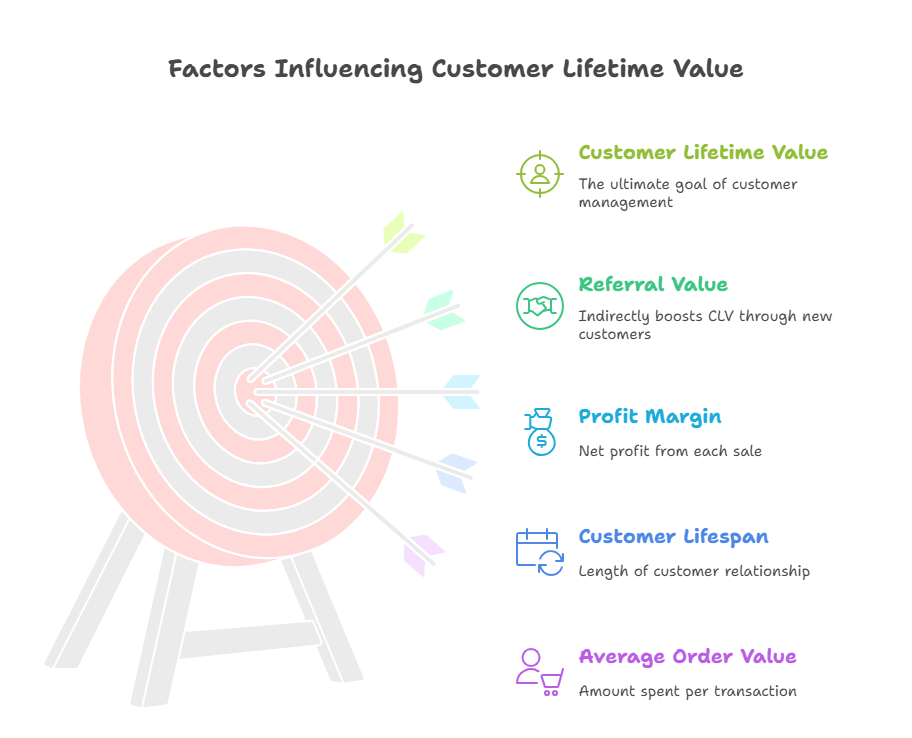

Key Factors That Impact CLV

Several variables directly influence your customers' lifetime value. Optimizing these levers is the key to improvement.

- Purchase Frequency: How often does a customer buy from you? Increasing repeat purchases boosts CLV.

- Average Order Value (AOV): The average amount spent per transaction. Strategies like bundling or tiered pricing can lift AOV.

- Customer Lifespan: The length of the relationship. Reducing churn and increasing retention directly extends lifespan and CLV.

- Profit Margin: Not all revenue is equal. The net profit from each sale, after accounting for costs of goods sold and service, is crucial.

- Referral Value: Happy, high-value customers often bring in new business through referrals, adding an indirect but significant boost to their total value.

Practical Ways to Improve Your CLV

Improving CLV is a continuous process that involves every customer-facing team. Here are actionable strategies derived from industry best practices.

Personalize the Customer Experience

Use CLV data to segment your audience. Provide high-potential customers with more personalized support, tailored communications, and exclusive offers. This investment in the relationship pays dividends in loyalty and longevity.

Implement Successful Upsell and Cross-Sell Programs

Since a significant portion of revenue comes from existing customers, develop strategic pathways for them to discover more value. This could mean recommending complementary products (cross-sell) or encouraging upgrades to higher-tier plans (upsell) at the right moment in their journey.

Proactively Reduce Churn

Identify at-risk customers before they leave. Use engagement data and satisfaction scores to intervene with targeted win-back campaigns, special support, or product education that reinforces the value you provide.

Optimize the LTV:CAC Ratio

Continuously monitor the balance between what you spend to acquire a customer and what they are worth. If CAC creeps too high, refine your marketing channels or improve conversion rates. If CLV is low, focus on the retention and expansion strategies above.

Mastering CLV requires organizing customer data, tracking the right metrics, and visualizing the relationship between acquisition cost and long-term value. For visual thinkers and strategists, mapping out these variables and their connections can unlock deeper insights.

Conclusion: CLV as Your Strategic Compass

Customer Lifetime Value is more than a metric; it's a philosophy of customer-centric growth. By defining CLV as the total worth of a customer to a business over the entirety of their relationship, you commit to valuing long-term loyalty over short-term gains. It provides a shared lens for sales, service, marketing, and product teams to align on what truly matters: cultivating profitable, lasting customer relationships that drive sustainable business success. Start calculating your CLV today, and let it guide your path to smarter growth.